The Philippines: Where Digital Wallets Lead the Way

A $36B market set to double by 2028. Now within reach with EBANX.

Global companies selling with EBANX in Rising Markets

EBANX solutions

in The Philippines

With EBANX, global merchants are able to reduce failed payments, improve customer trust, and unlock more revenue. Let locals buy as they prefer, while you keep business as usual - no local entity needed.

Pay-in

Receive payments with features that increase your total addressable market and count with the most relevant payment methods for digital purchases to boost your performance in cross-border sales with a reliable global settlement network.

International Funds Settlement to sell in local currency while accepting the most popular digital wallets. The funds can be received in USD, EUR and GBP anywhere in the world.

Direct connection with local acquirers

Optimized balance between approval rates and chargebacks

Support and performance optimization

Unified reconciliation

Local risk and compliance management

Optimized money flow considering multi-currency sales

One single and easy integration to accelerate go-live or upgrades

Exclusive and innovative technology developed in-house

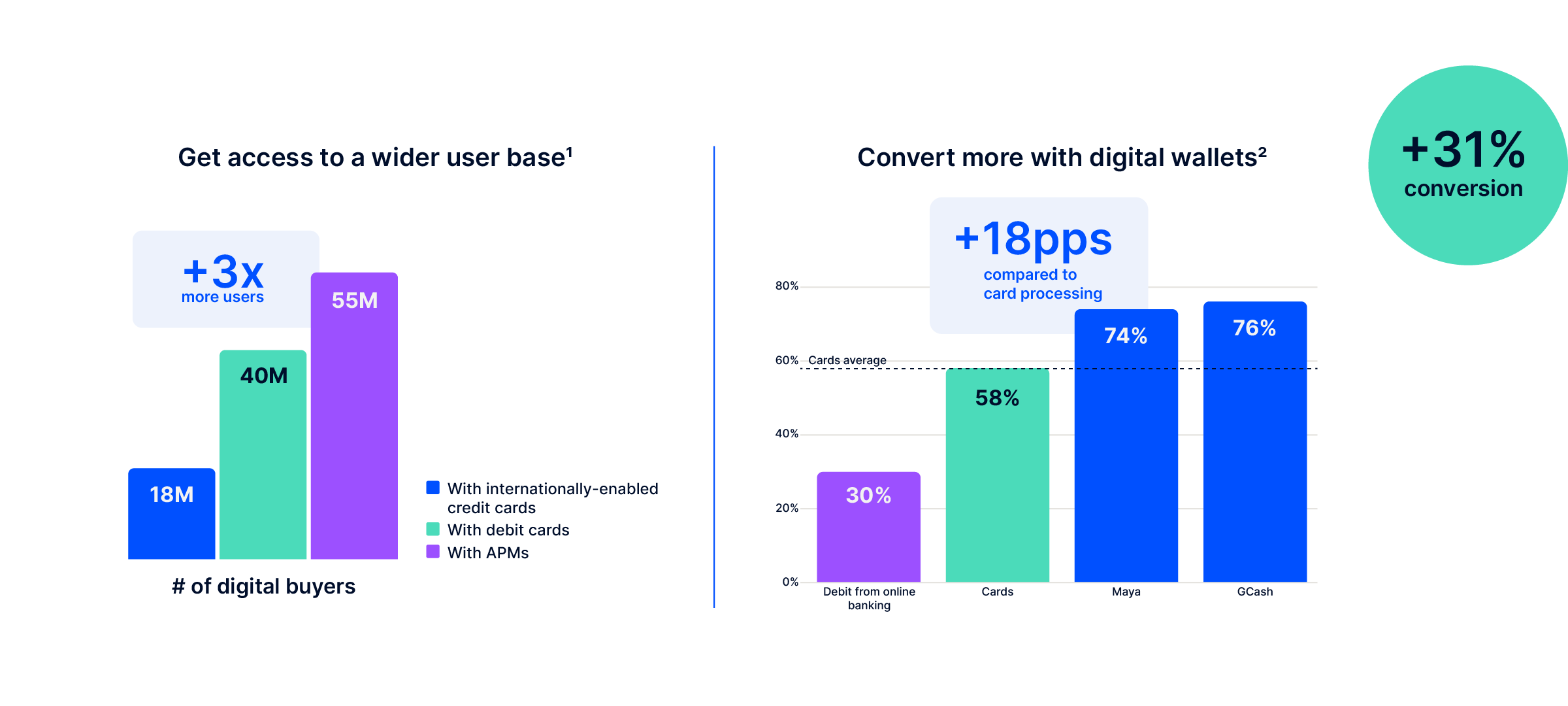

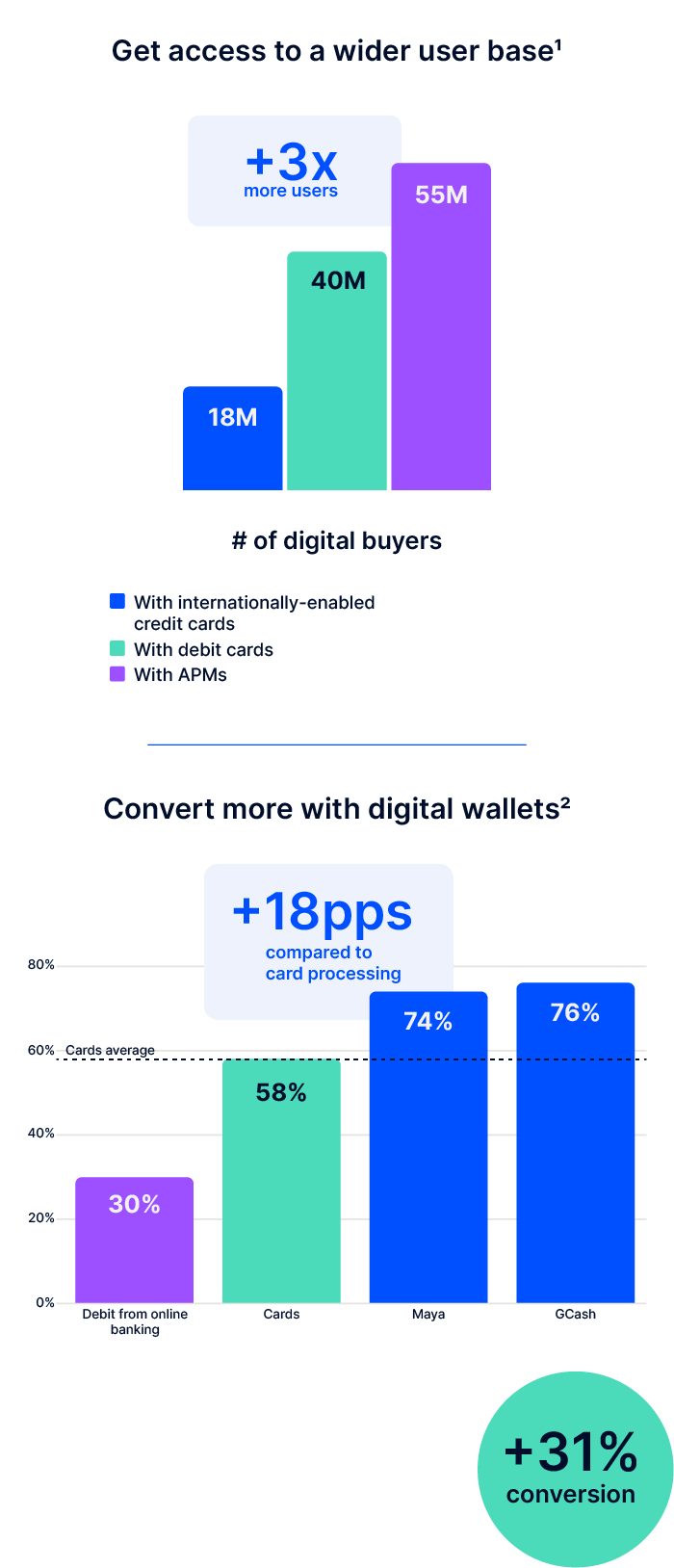

The EBANX Uplift in The Philippines

Cross-border transactions already make up nearly one-third of all online purchases in The Philippines, a growing share fueled by global brands entering the country.

In 2025, cross-border volume reached $10.2B, positioning international merchants as key players in shaping the local payments landscape. In sectors such as Retail, Gaming, and SaaS, digital wallets are rapidly becoming the preferred rails for seamless PHP checkout.

With EBANX, global merchants can tap into leading wallets like GCash and Maya to achieve higher conversion rates and unlock new revenue through localized payment experiences that truly connect with Filipino consumers.

Source: 1. EBANX Internal Data. 2. Market benchmark with local payment processors, 2025 • Conversion rates by order.

Payment methods available in The Philippines with EBANX

Digital Wallets

No

when a payment is made at intervalsYes

No

EBANX makes cross-border payments easy so you can focus on growth

Let your customers in The Philippines pay the way they prefer, and scale your business in one of Southeast Asia’s most mobile-first digital economies. All powered by EBANX’s local expertise and payment solutions.